A cost control accountant is responsible for planning, implementing, and maintaining cost control systems within an organization. They work closely with other departments to ensure that costs are being managed effectively and that the organization is meeting its financial goals.

Cost control accountants play a vital role in helping organizations to improve their profitability and financial performance. They can help to identify areas where costs can be reduced, develop strategies to reduce costs, and implement systems to track and control costs.

The historical context of cost control accounting can be traced back to the early days of industrialization. As businesses grew in size and complexity, it became increasingly difficult to track and control costs. Cost control accountants were developed to help businesses to overcome this challenge.

1. Planning

Planning is a critical component of a cost control accountant’s job description. Cost control accountants are responsible for developing and implementing cost control systems that help organizations to track, control, and reduce costs. These systems can include budgeting, variance analysis, and cost-benefit analysis.

Effective cost control systems can help organizations to improve their profitability and financial performance. For example, a cost control system can help an organization to identify areas where costs are too high, and then develop strategies to reduce those costs.

Cost control accountants play a vital role in helping organizations to achieve their financial goals. By developing and implementing effective cost control systems, cost control accountants can help organizations to improve their profitability, reduce costs, and make better decisions.

2. Implementation

Implementation is a critical component of a cost control accountant’s job description. Cost control accountants are responsible for working with other departments to ensure that cost control systems are being followed. This involves communicating with other departments, providing training, and monitoring compliance.

Effective implementation of cost control systems is essential for organizations to achieve their financial goals. For example, a cost control system can help an organization to identify areas where costs are too high, and then develop strategies to reduce those costs. However, if the cost control system is not implemented effectively, the organization may not be able to achieve the desired results.

Cost control accountants play a vital role in helping organizations to achieve their financial goals. By working with other departments to ensure that cost control systems are being followed, cost control accountants can help organizations to improve their profitability, reduce costs, and make better decisions.

3. Maintenance

Maintenance is a critical component of a cost control accountant’s job description. Cost control accountants are responsible for monitoring cost control systems and making adjustments as needed. This involves collecting data, analyzing data, and making recommendations to management.

Effective maintenance of cost control systems is essential for organizations to achieve their financial goals. For example, a cost control system can help an organization to identify areas where costs are too high, and then develop strategies to reduce those costs. However, if the cost control system is not maintained effectively, the organization may not be able to achieve the desired results.

Cost control accountants play a vital role in helping organizations to achieve their financial goals. By monitoring cost control systems and making adjustments as needed, cost control accountants can help organizations to improve their profitability, reduce costs, and make better decisions.

4. Reporting

Reporting is a critical component of a cost control accountant’s job description. Cost control accountants are responsible for preparing reports on cost control activities and making recommendations to management. These reports help management to understand the organization’s financial performance and make informed decisions about cost control.

Effective reporting is essential for organizations to achieve their financial goals. For example, a cost control accountant might prepare a report that shows that the organization is spending too much money on travel expenses. The management team could then use this information to develop strategies to reduce travel expenses.

Cost control accountants play a vital role in helping organizations to achieve their financial goals. By preparing reports on cost control activities and making recommendations to management, cost control accountants can help organizations to improve their profitability, reduce costs, and make better decisions.

FAQs on Cost Control Accountant Job Description

This section addresses frequently asked questions related to the job description and responsibilities of a cost control accountant, providing concise and informative answers to enhance understanding.

Question 1: What are the primary responsibilities of a cost control accountant?

Answer: Cost control accountants are responsible for planning, implementing, maintaining, and reporting on cost control systems within an organization, collaborating with various departments to ensure effective cost management and alignment with financial goals.

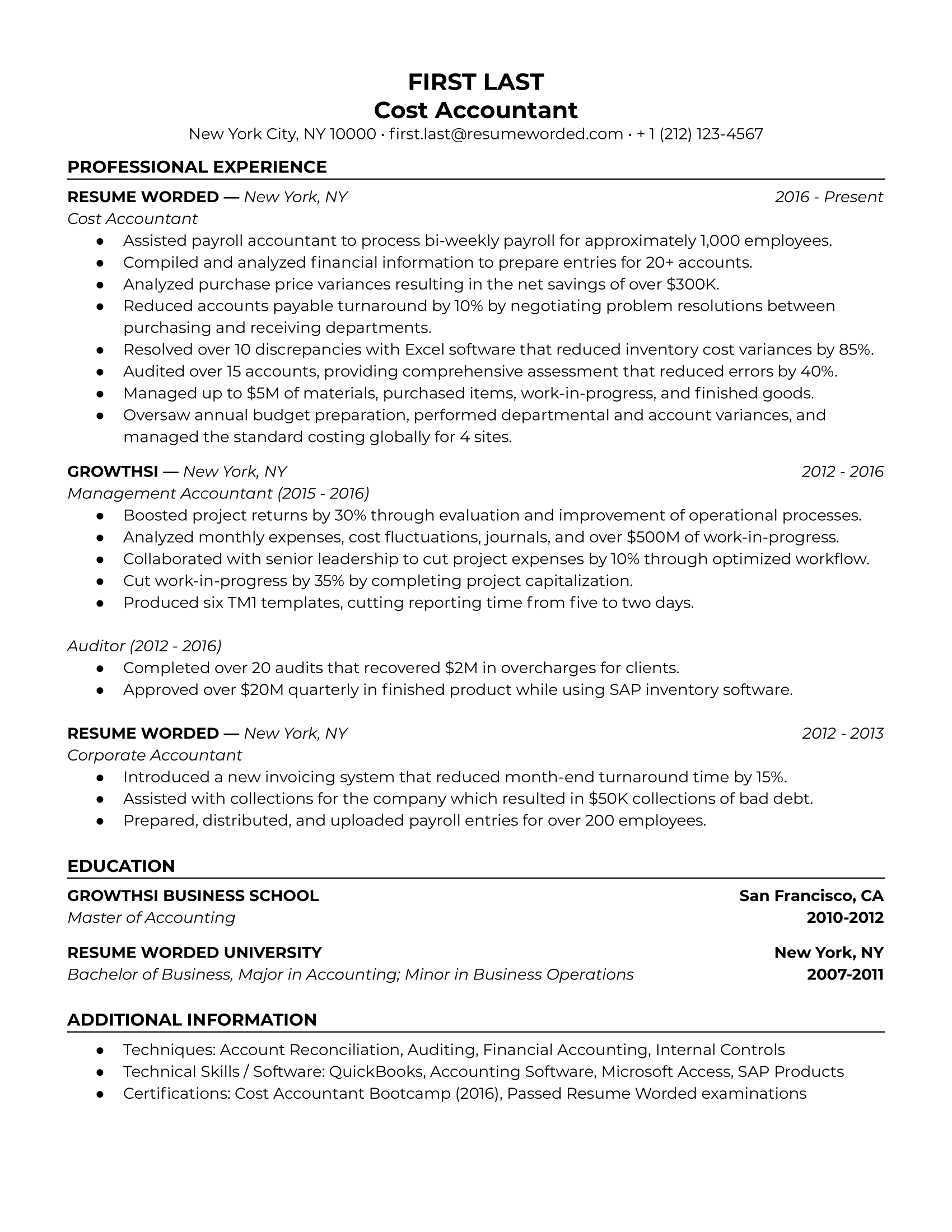

Question 2: What skills and qualifications are typically required for this role?

Answer: Cost control accountants typically possess a bachelor’s or master’s degree in accounting or finance, along with certifications such as CMA (Certified Management Accountant) or CIA (Certified Internal Auditor). Strong analytical, problem-solving, and communication skills are also essential.

Question 3: What industries or sectors commonly employ cost control accountants?

Answer: Cost control accountants are employed in a wide range of industries, including manufacturing, healthcare, retail, government, and non-profit organizations. Their expertise is valuable in any industry where cost management is crucial for profitability and financial sustainability.

Question 4: What career advancement opportunities are available for cost control accountants?

Answer: With experience and expertise, cost control accountants can advance to senior-level positions such as cost accounting manager, financial controller, or even CFO (Chief Financial Officer). They may also specialize in specific areas such as budgeting, forecasting, or internal auditing.

Question 5: What is the job outlook for cost control accountants?

Answer: The job outlook for cost control accountants is expected to be favorable due to the increasing demand for professionals skilled in cost management and financial analysis. Organizations across various industries recognize the importance of cost control for profitability and long-term success.

Question 6: What are some of the challenges faced by cost control accountants in their day-to-day work?

Answer: Cost control accountants may encounter challenges such as obtaining accurate and timely data, implementing cost-effective solutions, and gaining buy-in from stakeholders on cost-saving initiatives. They must also stay up-to-date with evolving accounting standards and industry best practices.

Summary of key takeaways or final thought:

Cost control accountants play a vital role in ensuring the financial health and profitability of organizations. Their expertise in cost management, analytical skills, and ability to communicate effectively make them valuable assets to any organization.

Transition to the next article section:

To further explore the role of cost control accountants and their contributions to financial management, continue reading the following sections.

Tips for Cost Control Accountants

Cost control accountants play a vital role in helping organizations improve their profitability and financial performance. Here are eight tips for cost control accountants:

Tip 1: Develop a cost control plan. A cost control plan is a roadmap for how you will manage costs within your organization. It should include your goals, objectives, and strategies for achieving them.Tip 2: Implement a cost control system. A cost control system is a set of procedures and processes that you will use to track, control, and reduce costs.Tip 3: Monitor your costs regularly. Once you have implemented a cost control system, it is important to monitor your costs regularly to ensure that you are on track to achieve your goals.Tip 4: Identify areas where costs can be reduced. Once you have monitored your costs, you can identify areas where costs can be reduced.Tip 5: Develop strategies to reduce costs. Once you have identified areas where costs can be reduced, you can develop strategies to reduce them.Tip 6: Implement your cost reduction strategies. Once you have developed cost reduction strategies, you need to implement them.Tip 7: Monitor the results of your cost reduction efforts. Once you have implemented your cost reduction strategies, you need to monitor the results to ensure that they are effective.Tip 8: Make adjustments to your cost control plan as needed. As your business changes, you may need to make adjustments to your cost control plan.